If you are a tenant or a landlord of commercial real estate property in Florida, you may be interested to know that the state sales tax rate on commercial rent has been reduced from 5.5% (plus the local surtax) to 4.5%, effective December 1, 2023. This means that the sales tax you pay or receive on the rent for leasing or using real estate for business purposes will be reduced.

What is the sales tax rate on commercial rent?

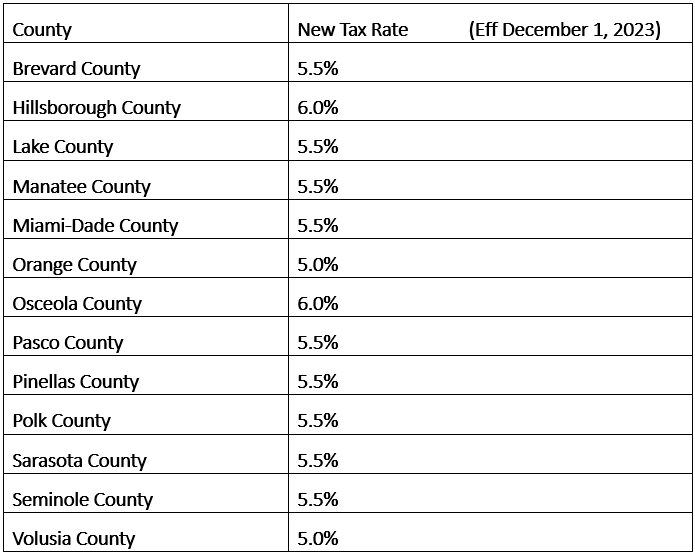

The sales tax rate on commercial rent consists of two components: the state sales tax rate and the local option discretionary sales surtax rate. The state sales tax rate is imposed by the state of Florida and applies to all counties in Florida. The local option discretionary sales surtax rate is imposed by the county where the real property is located and varies by county.

The state sales tax rate on commercial rent has been reduced by 1%. The local option discretionary sales surtax rate on commercial rent still applies.

The table below shows the new combined sales tax and discretionary sales surtax rate for certain Florida counties for 2023.

How does this impact Commercial Real Estate?

This reduction could translate into substantial savings for tenants These savings could then be reinvested into their main business activities, potentially driving growth, sparking innovation, or giving them a competitive edge in the market.

At the same time, this tax cut could be a benefit for landlords and property management companies, as it could make their properties more attractive to potential tenants. This could increase demand for commercial properties, which would be a positive development for commercial brokers.

In conclusion, the reduction in the state sales tax is likely to bring beneficial opportunities for both landlords and tenants alike. Commercial brokers should also see this as an opportunity to attract more clients and close more deals.

References: Chapter 2023-157, Laws of Florida; section212.031, Florida Statutes

Prepared by: Commercial Partners Realty, Inc.